Is the US stock market in peril? – Stock Market Faces Lingering Perils in 2022

For some years now we’ve heard a lot approximately how US shares would possibly go south. It’s now the autumn of 2022 and we’ve seen the securities and negotiable gadgets marketplace discover themselves in relatively a sticky scenario so, so our mission is to discover if there are any papers really worth making an investment in proper now and if so, which.

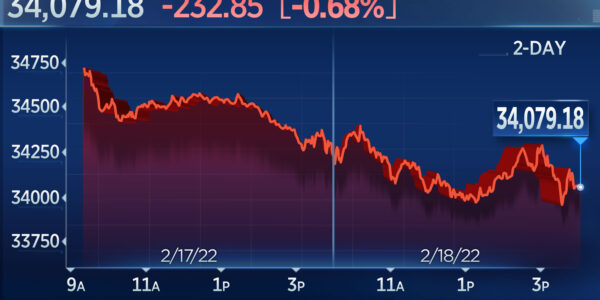

To kick things off, let’s test what’s been occurring with the main U.S. Indices over the past yr.

The Dow Jones Index an investor favorite agency together the expenses of 30 of the maximum traded stocks at the NYSE and the Nasdaq and has fallen nearly eight% over the year.

The S&P 500 index, measuring the overall performance of America’s 500 biggest stocks, has fared even worse.

In January 2022, experts attributed the marketplace decline to numerous factors: 1) traders had been looking ahead to the US Federal Reserve to raise the important thing price 2) US organizations published worse-than-expected first and 2d sector earnings, and three) geopolitical dangers have been regularly at the upward thrust.

But, the arena’s economies and exchanges have been knocked off-kilter much in advance than January. We’ve heard of the marketplace being too inflated and have heard calls for the pop when you consider that 2019, at which factor a touch factor called coronavirus entered the hoop and regrettably, nevertheless hasn’t yet absolutely left. This and greater has brought on a wave of complex geopolitical situations and a strength crisis that is affecting all corners of the globe – inclusive of however simply not limited to the United States.

At the identical time, the world’s delivery chain confronted improved disruptions and pressure, leading inflation to get worse inside the summer time of 2022, the US inflation rate reached forty-12 months excessive of eight.6% and the Fed began gradually hiking interest prices to try to deal with the escalation.

Some specialists consider there’s worse to come back. Enough to make the dot-com bubble appear like a stroll in the park.

So, aside from panicking, what movements are we able to take based on this information? Firstly, it’s a great concept to evaluate your portfolio to make sure it’s nicely assorted. What that means, is that it’s continually key to have an extensive sort of property for your portfolio from various global markets – even if you’re massive in American securities, having most effective the ones in your portfolio can be restricting.

You may want to take a look at different kinds of property. They may be bonds if you believe the return on them will outpace inflation, commodities like oil futures, real estate, or funding price range for an instance.

There is continually a risk to trading on a probable marketplace decline or securities fall. When one fights to the final ditch, every other receives rich regardless of the crisis, there are constantly character businesses or entire economic sectors that rake in earnings.

As we stated in advance, indices have fallen as a substitute catastrophically over the 12 months, by means of as plenty as 20% to mark a endure market for lots. But, let’s see which shares from those equal indices are defying the decline.

While the Dow Jones Index is down almost 8%, Chevron is up greater than 60% – and that’s excluding dividends!

Following Chevron in our scores comes UnitedHealth Group, a US-based insurance business enterprise with 26% YTD profits, and biopharmaceutical company Merck with its 18% YTD increase.

Next in line is the S&P 500. Considering it’s made of 500 large shares traded inside the US, the difference between the index chart and the charts of the top-gainer shares has to be even wider. Another oil and fuel massive, Occidental Petroleum, is on the pinnacle right here up 162%.

In the 2nd location, we’ve strength organization Devon Energy with a 141% growth, followed by means of electricity company and gas supplier Constellation up by using 108%. The energy region seems to be popping, and it’s no longer difficult to figure out why.

All those numbers show that even in instances of crisis, it’s viable to locate businesses that could ease mid and long-term investments despite the fact that finding isn’t constantly a piece of cake. Always keep in mind to take a look at the business enterprise whose securities you want to shop for and hold a near eye on general financial headwinds or in tl;dr phrases: Look first / Then leap.

For all latest news, follow The carefulu Google News channel.

For all latest news, follow The carefulu Google News channel.